Unlocking the Power of Trade 1000 Urex in Global Markets

In the evolving world of digital trading, Trade 1000 Urex has emerged as a powerful concept that is drawing significant attention from retail and institutional traders alike. With the rapid advancement in financial technologies, cross-border exchange platforms, and decentralized finance, the potential to trade 1000 Urex offers a strategic advantage for those seeking better yields, higher liquidity, and exposure to global markets. Whether you’re a beginner or an experienced trader, understanding the structure, benefits, risks, and strategies of using Urex tokens in modern trading can open the door to consistent profit opportunities.

Trade 1000 Urex isn’t just a buzzword; it’s a transformative approach to global investment. As more traders shift towards digital currencies and tokenized assets, Urex tokens are being viewed as a viable trading asset class. This article explores in detail what trading 1000 Urex means, why it matters, and how it can be leveraged to elevate your portfolio in the ever-competitive landscape of global finance.

What Is Trade 1000 Urex? A Deep Dive Into Tokenized Trading

Trade 1000 Urex refers to the process of buying, selling, or holding 1000 Urex tokens—a digital asset often associated with decentralized platforms that support secure and transparent trading mechanisms. Urex is a utility token commonly used in crypto-based ecosystems for various purposes such as staking, trading, or rewards.

Unlike traditional fiat currencies or stock assets, Urex tokens exist on blockchain networks, ensuring transparency, decentralized control, and fast transaction settlements. Trading 1000 Urex could imply a sizable investment or trade position in a digital asset that has real-world utility, depending on its exchange value and market performance.

The ability to handle this quantity in one trade implies a significant opportunity for both short-term gains and long-term appreciation. Traders who deal in such quantities usually aim to capitalize on market movements through technical and fundamental analysis.

How to Get Started With Trade 1000 Urex Efficiently

Before entering the Urex token market, it’s essential to understand the required tools, platforms, and knowledge. Begin with creating a digital wallet compatible with the blockchain Urex operates on—this ensures safe storage of your tokens. Then, choose a trading platform or decentralized exchange (DEX) that lists Urex with strong liquidity.

Ensure your chosen exchange provides real-time market data, trading charts, and integration with tools like stop-loss, limit orders, and automated trading bots. Once your account is verified and funded, you can initiate a trade involving 1000 Urex based on your market outlook.

Here are essential steps to begin:

- Choose a secure wallet that supports Urex.

- Use a trusted exchange with verified Urex listings.

- Start with demo trading if available to build strategy confidence.

- Analyze market trends using technical indicators.

- Begin trading with controlled risk exposure.

Benefits of Trading 1000 Urex in Digital Markets

Engaging in the trade of 1000 Urex offers multiple financial and strategic benefits. With blockchain-based security and efficient cross-border transactions, Urex makes trading more accessible and cost-effective. Moreover, trading this token in such quantity provides you with stronger market influence, better arbitrage opportunities, and access to high-value trading pools.

Key Benefits Include:

- High Liquidity: Popular exchanges listing Urex ensure easy buy/sell transactions.

- Low Transaction Costs: Blockchain minimizes overhead fees.

- Global Accessibility: Trade anytime, anywhere, without bank interference.

- Scalable Investments: Ideal for portfolio diversification.

- Transparent Records: All trades are logged on immutable blockchain ledgers.

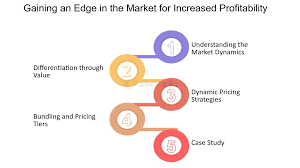

Market Strategies for Trade 1000 Urex: Maximize ROI

To gain maximum value while trading 1000 Urex, one must adopt a well-researched trading strategy. These strategies include both technical and fundamental approaches, risk management protocols, and leveraging market news to predict price actions.

Swing trading and scalping are two popular strategies for tokens like Urex, especially when price volatility is high. Swing traders hold positions for several days to weeks, capitalizing on medium-term trends, whereas scalpers perform numerous small trades daily, targeting minor price fluctuations.

Advanced traders also use algorithmic bots to trade Urex automatically based on predefined conditions. These strategies reduce emotional trading decisions and enhance profit consistency.

Analyzing Risk When You Trade 1000 Urex

While the rewards of trading 1000 Urex can be substantial, it’s critical to understand and manage risks. Market volatility, regulatory changes, and liquidity crunches are some of the common threats faced by crypto traders.

Trading larger amounts, such as 1000 Urex, means you are exposed to a higher capital loss if the market moves unfavorably. Risk management tools such as stop-loss orders, diversified asset allocation, and regular monitoring are crucial.

Also, consider the security of your digital assets. Use hardware wallets for storage and enable two-factor authentication on all trading platforms. Never invest more than you can afford to lose, and always stay updated with market news.

Urex Tokenomics and Its Role in Trading Efficiency

The underlying economic design—or tokenomics—of Urex significantly impacts its trading potential. Factors like the total supply, circulating supply, burn mechanisms, and staking incentives influence price movements and investor confidence.

Understanding how Urex is minted or burned can help you predict long-term valuation trends. For instance, a deflationary model where tokens are regularly burned leads to scarcity, potentially increasing demand and price. On the other hand, high inflation in token supply can devalue holdings.

Tokenomics is essential not only for trading 1000 Urex effectively but also for long-term holding decisions, especially if Urex is part of a broader DeFi or NFT ecosystem.

Technical Analysis: Tools for Trading 1000 Urex

To trade 1000 Urex efficiently, leveraging technical analysis is indispensable. Tools like moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Fibonacci retracement help traders forecast price movements and entry/exit points.

Candlestick patterns also offer deep insight into market psychology. Bullish engulfing patterns, dojis, and hammers are signs of potential trend reversals that traders must understand. Combining these patterns with volume indicators helps confirm the strength of a movement.

Trading platforms like TradingView provide excellent charting tools and integration with Urex-compatible exchanges, enabling a seamless strategy deployment experience.

Trading Platforms Supporting Trade 1000 Urex

Not every exchange supports Urex tokens or large-volume trading. Choosing a trading platform with robust infrastructure, regulatory compliance, and adequate liquidity for 1000 Urex trades is vital.

Top decentralized exchanges (DEXs) or centralized platforms (CEXs) known for listing new and emerging tokens like Urex should be your go-to. Look for platforms offering advanced trading interfaces, 24/7 support, and real-time charting.

Also, ensure that the exchange allows external wallet connectivity for asset withdrawal and supports layered security protocols to prevent unauthorized access or hacking attempts.

Economic Impact of Trade 1000 Urex on Digital Ecosystems

Large-scale trading of tokens like Urex contributes directly to the growth and maturity of digital finance ecosystems. It enhances liquidity, promotes token stability, and fosters decentralized finance adoption among institutions.

When more users trade in larger quantities, it signals increased trust in the token’s reliability and potential. This drives up demand, reduces volatility, and encourages developers to build more utilities around the Urex ecosystem, such as lending, staking, and NFT integrations.

Such economic participation creates a positive feedback loop where increased utility boosts demand, which in turn enhances market cap and user confidence.

Case Study: Real-World Example of Trading 1000 Urex Successfully

A trader from Singapore recently shared how he turned a modest investment into a substantial gain by trading 1000 Urex strategically during a high-volume week. Using a mix of sentiment analysis and technical indicators, he identified a support level and entered the trade right before a bullish breakout.

By setting tight stop-losses and gradually taking profits at resistance zones, he minimized risk and locked in gains. His disciplined approach highlights the importance of strategy, timing, and ongoing market analysis when trading such significant token amounts.

This real-world success story serves as inspiration for those looking to explore the trade 1000 Urex space seriously and professionally.

Conclusion: Is It Worth Trading 1000 Urex Today?

Trading 1000 Urex is not just feasible; it is a strategic move in the modern era of digital finance. From accessibility to profit potential, from utility-based growth to secure decentralized frameworks—Urex stands out as a versatile asset for the proactive trader.

However, the market is dynamic and requires continuous research, adaptability, and risk awareness. For those who are equipped with the right tools, information, and mindset, trading Urex can be an efficient way to participate in the next wave of global finance.

If you’re ready to explore new opportunities in decentralized finance or looking to expand your crypto trading strategies, Trade 1000 Urex could be your gateway to long-term profitability.

FAQs on Trade 1000 Urex

1. Is it safe to trade 1000 Urex on decentralized platforms?

Yes, as long as the platform is reputable and security protocols are in place, trading Urex on DEXs is generally safe.

2. Can beginners start trading with 1000 Urex?

Beginners should first understand the market, start with smaller amounts, and only move to 1000 Urex when confident in their strategy.

3. What is the best time to trade Urex?

Ideal trading times vary, but generally, higher liquidity and better price movements occur during overlapping global trading sessions (e.g., U.S. and European hours).

Also Read This: Everything You Need to Know About 鲁Q 669FD